Overdraft Election Options | Santander Bank - Santander

How we handle

overdrafts

Overdraft Election

Every time you open a Santander Select® Checking, a Simply Right® Checking, Santander® Private Client Checking, or any savings or money market account, you elect one of two options – SOME Overdrafts or ALL Overdrafts – for payment of your overdrafts.

Your election options:

SOME Overdrafts

Selecting this option means Santander may authorize and pay transactions and overdraw your account, EXCEPT:

- ATM transactions

- One time Debit Card purchases

When you choose this option, we generally decline ATM transactions and one time Debit Card purchases and we will not charge you a fee.

You agree that we can charge you a fee for each paid item, up to three (3) per Business Day, when you do not have sufficient funds.

ALL Overdrafts

Selecting this option means Santander may authorize and pay any transaction and overdraw your account, INCLUDING:

- ATM transactions

- One time Debit Card purchases

When you choose this option, you agree that we can charge you a fee for each paid item, up to three (3) per Business Day, when you do not have sufficient funds.

| | It's important to understand that regardless of which option you choose: We do not guarantee that we will always authorize and pay any type of transaction when you do not have sufficient available funds. |

|---|

How does Santander choose whether to process a transaction?

We typically consider a variety of factors, including the size of the transaction, whether your account is in good standing, and/or if you have had too many recent overdrafts.†

Here's an example of how SOME Overdrafts and ALL Overdrafts works.

Here is a real world example to help you understand the differences between SOME overdrafts and ALL overdrafts elections.

| Transactions | SOME Overdrafts BALANCE | ALL Overdrafts BALANCE |

|---|---|---|

| Emily has a starting balance of $60 | $60 | $60 |

| She uses her debit card to purchase lunch for $32 | $28 | $28 |

| When she gets home, she goes online and tries to use her debit card to order a new $150 chair for her home office. The transaction is declined with SOME and approved with ALL. | Declined | ($122) |

| With ALL, Emily is charged a $15 overdraft fee since she is overdrawn by more than the $100 threshold, whereas under SOME, no fee is charged as the transaction was declined. | $28 | ($137) |

| The next day an automatic payment for $90 is debited from Emily's account to pay for her electricity bill. Under either choice, the transaction goes through. | ($62) | ($227) |

| With SOME, Emily ends up under the $100 threshold so no overdraft fee is charged. With ALL, a further $15 overdraft fee is charged as she is over the $100 threshold. | ($62) | ($242) |

| Total Overdraft Fees Charged: | $0 | ($30) |

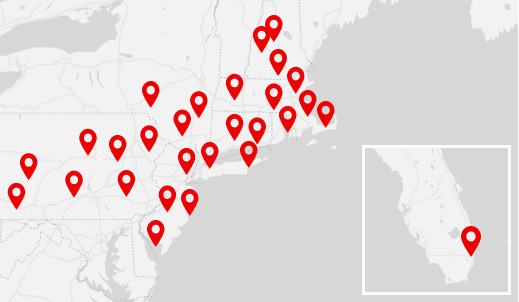

Find Us

Find Us

†Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn for an extended period of time or the overdrawn amount is excessive. Any overdrafts that we pay must be promptly repaid by you.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC